Optimize your Fiscal Advice.

TaxMachine is a gross-net calculator on steroids for the modern accountant or financial advisor.

All relevant legislation has been converted into computer code:

| Calculate and optimize net personal income | |

| Visualize net salary, retirement, benefits in kind, ... | |

| Compare company director, sole proprietorship and employee | |

| Tune any situation via 1000+ parameters |

- €16292.640.44%Annual tax without optimization

- €8314.75 saved!€7977.8524.95%Annual tax with TaxMachine

More net

Save taxes

TaxMachine takes into account all tax aspects and details of a financial situation. From expenses for childcare to desired retirement. Mathematical optimization ensures the best net result for your customer.

Enhanced customer loyalty

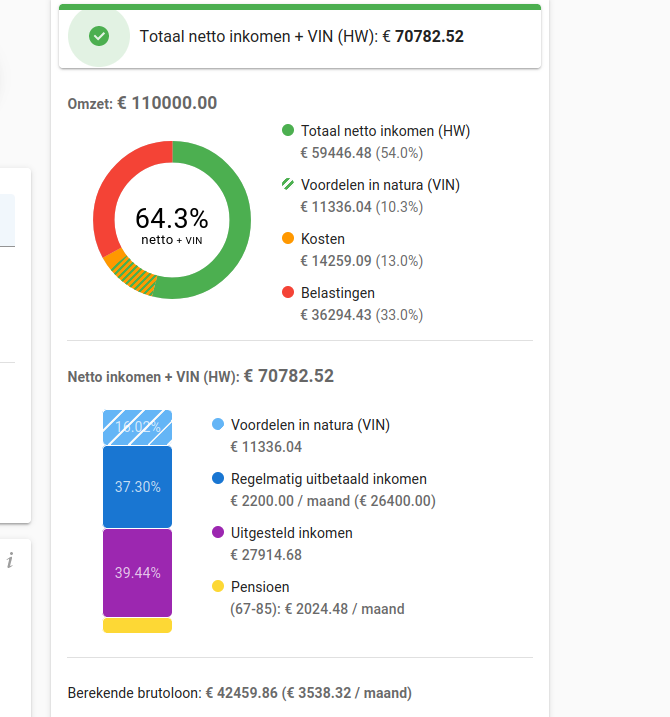

Visualize your advice

The outcome of a tax decision is immediately reflected in a resulting net amount and presented graphically. Easy to understand by your customer. Simulations and optimizations can be executed and compared together.

Less work

Save time

Entering data is easy, through a wizard or an uploaded tax bill. TaxMachine performs the calculation or optimization in seconds instead of hours. And it does all that with knowledge of the most recent tax legislation, so that you don't lose time with keeping track of constant changes.

Numerous use cases

Countless possibilities

Stop messing around in Excel. TaxMachine does everything faster, easier, 100% accurate and optimal. Your customer will notice the difference.

Onboarding of starters

Upload a tax bill and enter data about the car and other benefits together with your customer.

TaxMachine calculates the net value of the total salary package, including retirement and the full salary costs.

With one click, the necessary turnover as a sole proprietorship and as a manager is displayed.

Compare all possible options together and optimize according to your customer's wishes.

Use TaxMachine's proposals and to-do list to efficiently set the company up.

Optimization of companies

Enter the current financial situation of the manager and company.

Let TaxMachine optimize automatically in one click. If desired, make a selection of the permitted optimization methods.

Immediately see the effect of the optimization on the taxes to be paid and on the net personal income.

Use TaxMachine's proposals and task list to implement the optimizations.

Comparison of cars on net TCO

Enter the current financial situation of the manager, employee or sole proprietorship.

Copy the entry (and delete the car).

Add a car that you want to compare by simply selecting the make, model and version.

TaxMachine immediately shows a comparison of total net costs and taxes.

Compare multiple cars by repeating steps 2, 3 and 4.

Want to see the use cases in action?

Curious about even more possibilities?

User experience

Simple and effective

Onboarding a new customer, year-end closing decisions or continuous optimization. TaxMachine helps you make the best tax decisions in a simple but well-considered way.

Innovative technology

Tax legislation to code

TaxMachine consists of various components, each representing a branch of tax legislation.

They were built by converting textual laws into mathematical formulas. They are

continuously kept up-to-date through a combination of machine learning and tax expertise.

The components are intertwined to provide complete simulations

about a person's financial situation. This is done with algorithms that use the cloud

to optimize various parameters, such as minimal turnover, optimal salary and optimal saving capacity.

Personal income tax

Withholding tax

Corporate law

VAT

Social legislation

Traffic Law

Statutory pension

Retirement Savings Plans

Ready to get started?

Book an introductory meeting immediately. In this half hour we give a short demo of our product. Together we will look at what its use can mean for you.